Steve Pope

Berkshire Q2 Earnings - Low Expectations Easily Beaten

Many analysts had low expectations headed into Berkshire Hathaway's (NYSE:BRK.A) (NYSE:BRK.B) first half 2023 results. The preview article here on Seeking Alpha quotes the CFRA analyst, who estimated 2Q operating earnings of $3.94 per B share vs. $4.21 in 2Q 2022. Andrew Bary of Barron's spoke to a UBS analyst for his preview. That analyst had an "above consensus" estimate of $3.99. Actual results showed operating earnings of $10.04 billion, or $4.62 per B share. Congrats to Seeking Alpha's Fishtown Capital, who nailed it with his prediction of $10 billion.

How did the "experts" get it so wrong? For the most part, they predicted underwriting losses in insurance while Berkshire actually produced strong gains, especially at Geico. Some of this was a reversal of overly conservative future loss estimates made in earlier years. However, Geico also got out ahead of its competitors in cutting advertising and focusing on profitability over policy count.

The strength in insurance more than offset another disappointing quarter at BNSF Railroad, where volumes fell much more than at competitors. Berkshire Hathaway Energy had an in-line quarter, following a 1Q result that was hurt by reserves for a lawsuit over 2020 wildfires in Oregon and Northern California. Berkshire results also gained as it enjoyed the first full quarter of majority ownership in Pilot travel centers.

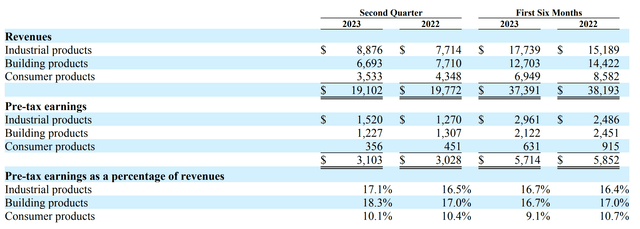

Within manufacturing, service, and retail, we see that industrial products manufacturing was a bright spot, helped by last year's Alleghany acquisition as well as a recovery in the aerospace and automotive businesses. This more than offset a slowdown in building and consumer products manufacturing as well as non-auto retail.

Berkshire Hathaway continues to add value through its prudent management. In particular, conservative insurance underwriting standards and M&A activity are both paying off this year, defying analysts' low expectations. Despite the recent runup in the share price, my sum-of-the-parts valuation is still about 13% above market price. Book value has also risen in line with share price for the last several quarters, with the price/book ratio having held constant around 1.4. Let's look at the details.

Insurance

Insurance was the biggest positive surprise to most observers this quarter. Geico's competitors in the primary insurance business Allstate (ALL) and Progressive (PGR) both reported large catastrophe losses. Allstate noted,

"Severe weather resulted in 42 catastrophe events, where we remediated losses for 160,000 customers, causing net catastrophe losses of $2.7B in the quarter,"

Progressive had similar commentary in their most recent results:

During the second quarter 2023, we experienced 19 catastrophic weather events that contributed 7.1 points to the underwriting loss, compared to 4.3 points of catastrophe losses for the second quarter last year. These storms were broad-based and impacted 35 states during the quarter. Nearly 60% of the catastrophe losses were in our vehicle businesses while the remaining was in our Property segment. During the first half of 2023, only six states were not affected by catastrophic events.

Berkshire told a different story in the latest 10-Q, noting no significant cat events in 2Q.

We currently consider pre-tax incurred losses exceeding $150 million from a current year catastrophic event to be significant. Significant catastrophe events in the first six months of 2023 were a cyclone and floods in New Zealand and floods in Australia in 2022. Each of these events occurred in the first quarter of the year.

Now, it may be that Berkshire's threshold for what constitutes a catastrophic event is higher than competitors, however it's also worth remembering that Geico focuses exclusively on vehicle coverage, while the others offer homeowner's policies as well.

Geico has also focused heavily on profitability over policy count in the past year. Premium increases have kept the dollar amount of premiums earned close to last year's levels despite a 14.4% decrease in policies in force. The lower focus on new customers has also reduced advertising expenses, reducing underwriting expense ratio by about 2 percentage points. Together with a lower loss ratio, Geico's combined ratio was 94.7 in 2Q, down from 105 last year.

Progressive went the opposite direction, moving from 95.6 to 100.4. After growing policies in force by 12%, they have only just decided to cut advertising in 2Q. Geico's underwriting discipline may have looked uncompetitive last year but it has paid off in the long run.

One final driver of the surprising results at Geico was a reduction in future loss estimates made in prior years. This reduced total reported losses by $888 million in 1H 2023 vs. $207 million in 1H 2022. This $671 million improvement represents about 35% of the improvement in Geico's underwriting earnings. Again, conservatism helped Geico while Progressive went the other way.

During the second quarter 2023, we experienced unfavorable prior accident years reserve development of 3.4 points, compared to favorable development of 0.4 points during the second quarter last year

Source: Progressive 10-Q

Outside of Geico, Berkshire's other primary insurance business was much more stable, continuing to generate underwriting profits with combined ratios in the low 90s. The reinsurance business grew in property and casualty thanks to the Alleghany merger, while the retroactive reinsurance and annuity businesses posted lower results due to foreign exchange effects.

Insurance investment income also showed a big improvement thanks to higher interest rates on Berkshire's large cash balance. Interest income was up by over a factor of 6 from last year. This more than offset a drop in dividend income from stock sales as well as the Occidental (OXY) dividends now booked as a capital return under the equity method.

BNSF Railroad

It was nice to hear management acknowledge BNSF's problems at the annual meeting but they seem no closer to solving them. Car loads were down 11.1% compared to last year, a worse performance than in 1Q. Intermodal volume suffered the most, with lower west coast imports, loss of a customer, and competition from trucking. By comparison, Union Pacific's (UNP) volumes were only down 2% in the quarter, with intermodal down 7%. All railroads suffered cost pressures in the quarter. At Union Pacific, operating expense ratio was up 2.8% to 63.0% but BNSF did even worse with a 5% increase to 68.2%. I am revising down my earnings estimate for BNSF this year by 11%, to $5 billion.

Berkshire Hathaway Energy

BHE had steady results in the quarter compared to a year ago after PacifiCorp took a charge in 1Q for liability for the 2020 wildfires in Oregon and northern California. Berkshire Hathaway Realty was also a drag, though not as big as it was last quarter. BHE's negative tax rate due to wind power production tax credits continues to be a source of value hidden from most casual observers.

Looking forward, BHE's earning power will increase when the company acquires another 50% stake in Cove Point LNG from Dominion (D).

Pilot Travel Centers

Pilot had slight lower fuel sales by volume in 2Q, but higher margins, resulting in improved gross profit. Reported operating expenses increased, but this was due to higher amortization from assets being marked up based on the high acquisition price Berkshire paid earlier this year. Interest expense was also up more than double due to higher rates. Pilot's debt is mostly variable rate and averaged 7% last quarter, probably the highest within Berkshire. The parent company does not guarantee Pilot's debt. Still, it would be nice to see Berkshire find a way to replace this with lower rate fixed debt based on its financial strength.

Berkshire's stake in Pilot is valued at $14.4 billion based on the purchase price paid earlier this year. I estimate Berkshire will earn $520 million this year from the 80% stake in Pilot, however if you add back the acquisition amortization, this would be more like $1.1 billion. At 13 times earnings, my earlier worry that Berkshire overpaid is now not as serious.

Manufacturing

Industrial Products was the standout group within Manufacturing. Some of this was due to the Alleghany acquisition, however improvement in the aerospace industry is helping Precision Castparts, a factor that I have also noted in recent articles on RTX (RTX) and Eaton (ETN). The Building Products group is slowing along with lower housing demand from high interest rates. The decline was partly offset by margin improvements due to lower energy and shipping costs. Consumer products, the smallest of the three groups, had the biggest slowdown. Forest River (RV sales) was the key driver of the slowdown.

Berkshire Hathaway

With industrial products holding up better and margins improving, I increased my 2023 earnings estimate for Manufacturing by 10% to $8.7 billion.

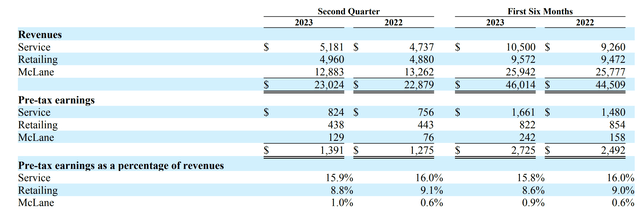

Service And Retail

Aviation was the story again for the Service group, with NetJets and Flight Safety leading the way. Retail held up fairly well thanks to the high concentration in Berkshire Hathaway Automotive which showed strong improvement, offsetting a 18.2% drop in earnings at the other retail businesses. Food distributor McLane had lower volumes but higher earnings. Margins improved due to lower fuel costs.

Berkshire Hathaway

Aviation and automotive continue to hold up. Other retail, while lower compared to last year, has improved sequentially vs. 1Q. I am increasing my earnings estimate for Service and Retail by 3% to $4.15 billion.

Investment Portfolio

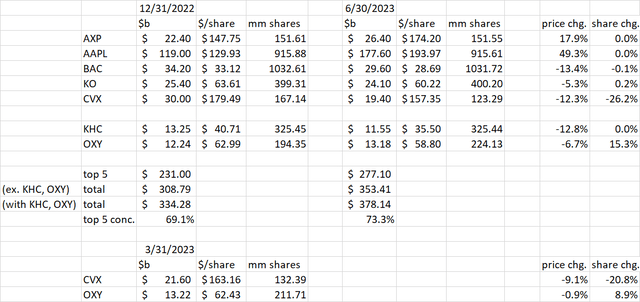

We will have to wait for the 13-F for most of the details, but the cash flow statement shows that Berkshire was a net seller of $8 billion of equities in 2Q. Berkshire's top 5 holdings are listed in the 10-Q, and they make up about 73.3% of the total holdings if we include the equity method investments in Kraft Heinz (KHC) and OXY. Berkshire made no trades in the top 4 names American Express (AXP), Apple (AAPL), Bank of America (BAC), and Coca-Cola (KO). They did sell another 9.1 million shares of Chevron (CVX), or about $1.5 billion worth, after selling 34.75 million shares in 1Q. We can also see that Berkshire bought an additional 12.4 million shares of OXY in 2Q for about $750 million. We also know from other filings that Berkshire reduced its stake in Activision Blizzard (ATVI) to 1.9% from 6.7% in 2Q, ahead of positive news from regulators indicating the merger is more likely to close. I estimate this sale raised about $3 billion of cash.

Author Spreadsheet

Capital Management

Berkshire's insurance float growth has slowed after last year's Alleghany purchase. It grew by another $1 billion in 2Q after a similar increase in 1Q. The float is now $166 billion. Berkshire's cash and T-Bill position is now $141.9 billion, which is $14.2 billion higher than at the end of 1Q. With T-Bills yielding around 5.5%, the company can afford to take its time entering new investments.

Share buybacks in 2Q slowed to $1.4 billion from $4.45 billion in 1Q. YTD, the company has repurchased about 0.9% of its starting market cap. Free cash flow has improved considerably at $12.7 billion YTD compared to $8.5 billion in 1H 2022.

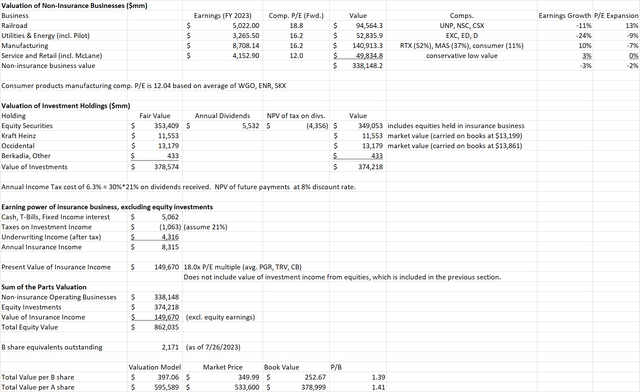

Berkshire Stock Valuation

My regular sum-of-the-parts valuation model is presented below.

Adding it all up, I now value Berkshire at $397.06 per B share, an upside of 13.4% from market price. This is just a slightly wider premium to market price compared to the 11.9% upside I calculated last quarter. The insurance business is worth more thanks to both higher investment income and better underwriting performance in a period where peers struggled. The equity portfolio is worth more due to market appreciation. The other businesses are valued slightly lower as a group. As good as BHE is, I was probably too optimistic with the earnings estimate last quarter. Peer P/E multiples for utilities have come down as well. This was partly offset by higher earnings estimates for Manufacturing, Service, and Retail. While the BNSF earnings estimate went down, peer multiples went up leaving the valuation little changed.

Author Spreadsheet

The 1.4 times book value result is the same multiple as the last few quarters and in line with the average over the past 10 years.

Conclusion

Expectations were low for Berkshire Hathaway going into the 2Q earnings release, but the company managed to blow them away with exceptional insurance results. Conservative underwriting standards and focus on profitability over policy growth are paying off at Geico much as they always have in the other insurance businesses. Aviation and automotive businesses in Manufacturing, Service, and Retail are bright spots, offsetting slowdowns in other areas. Conservative capital management helps as well. With cash earning 5.5%, the company need not be in a hurry to make deals. Rather than bagging an "elephant", Berkshire's medium-sized acquisitions of Alleghany and Pilot are paying off this year. BNSF is really the only sore spot.

The share price's steady relationship with book value and 13% discount to intrinsic value won't produce a get rich quick opportunity, but it makes Berkshire Hathaway a stabilizing force for a portfolio, holding value during periods of volatility and growing value gradually over time.

Article From & Read More ( Berkshire Hathaway Stock: Q2 Earnings Results Blew Away Bears - Seeking Alpha )https://ift.tt/Df4KsBW

Business

Bagikan Berita Ini

0 Response to "Berkshire Hathaway Stock: Q2 Earnings Results Blew Away Bears - Seeking Alpha"

Post a Comment