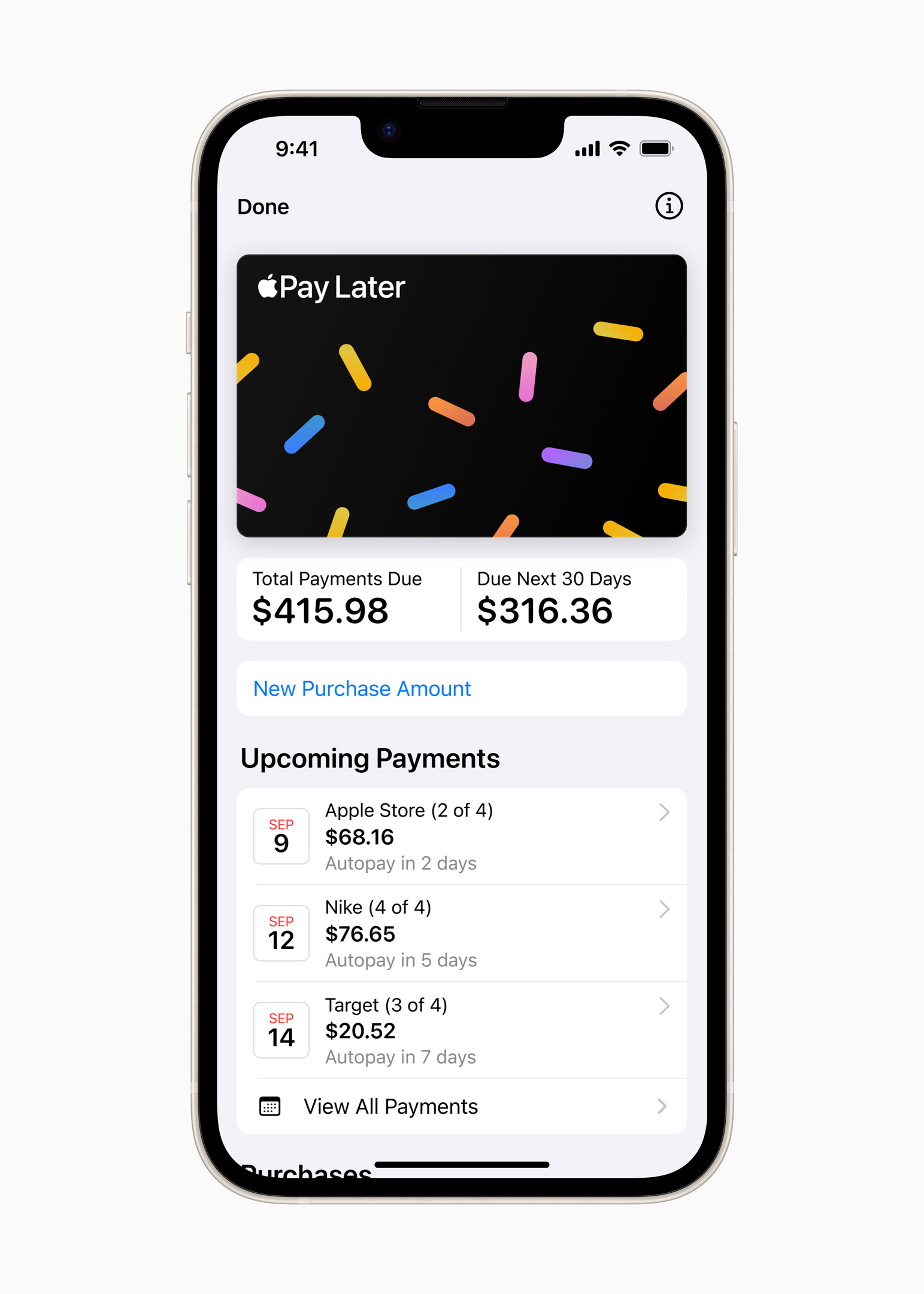

This is the main view for the Pay Later feature in Apple's Wallet app for the iPhone.

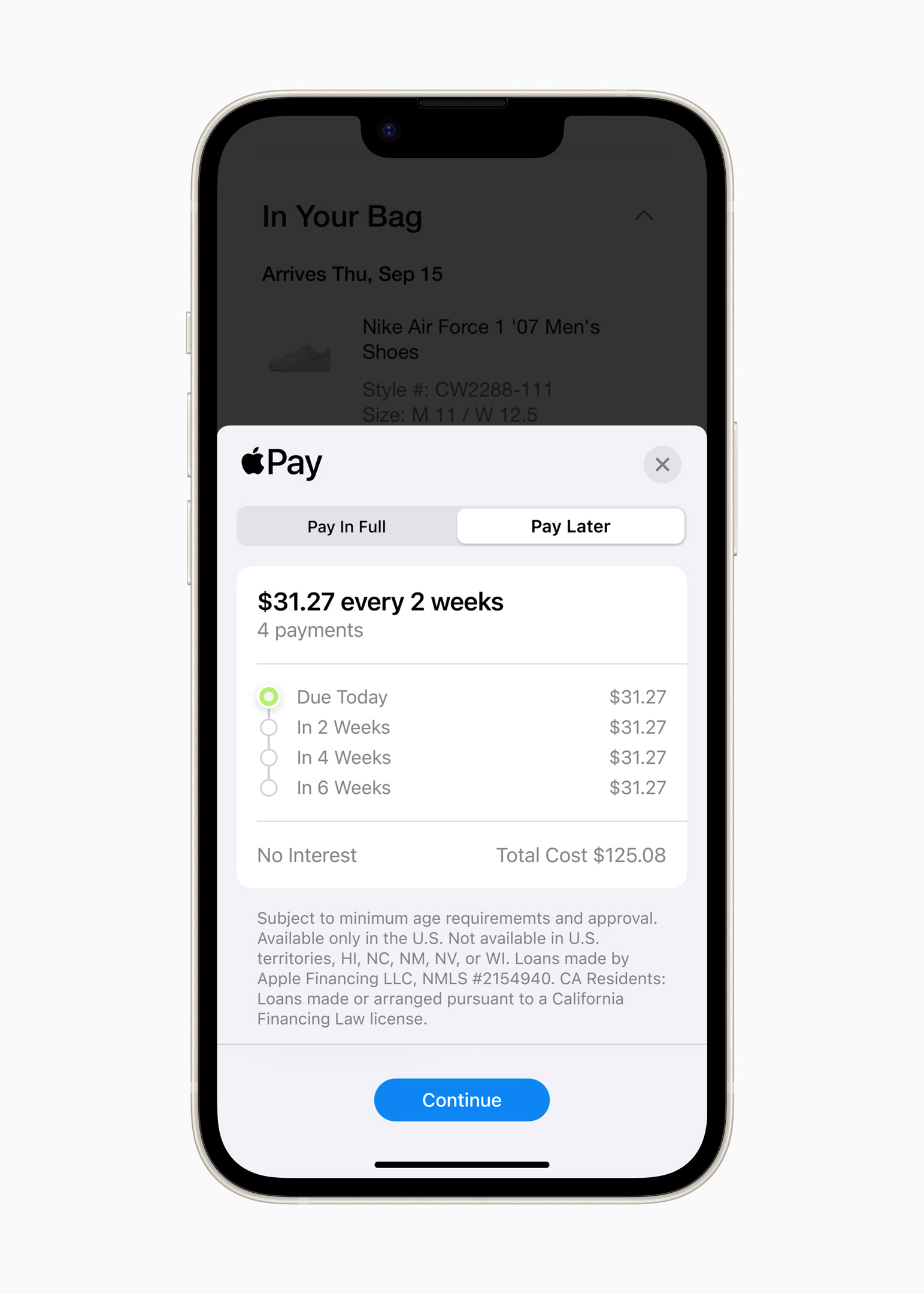

This is the main view for the Pay Later feature in Apple's Wallet app for the iPhone. When users are approved for a loan, Apple details the payment plan and amount before confirmation.

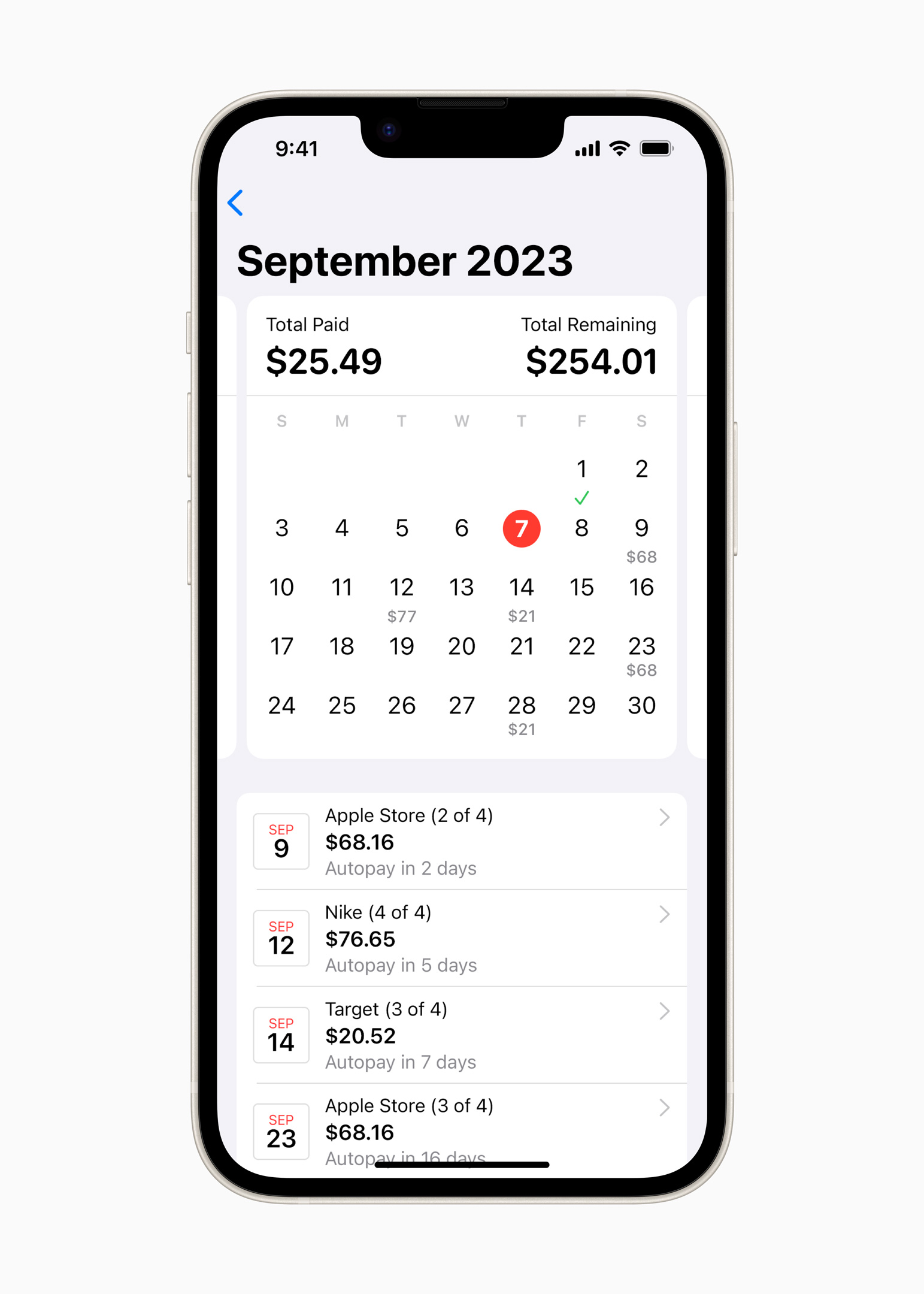

When users are approved for a loan, Apple details the payment plan and amount before confirmation. Users can then track the loan and scheduled payments via an in-app calendar.

Users can then track the loan and scheduled payments via an in-app calendar.

With the limited launch today of a new service called Apple Pay Later, Apple will now lend money directly to users through the Wallet app on devices like the iPhone.

We first heard about the service in 2021, and it was officially announced at the company's Worldwide Developers Conference in June 2022. It faced several delays, though, as iOS 16 began to roll out last September.

Now Apple is "inviting select users to access a prerelease version of Apple Pay Later." The service will roll out to everyone "in the coming months."

Those who can use it now can apply for loans ranging in amount from $50 to $1,000—but they'll only be able to spend the lent money with merchants (online or otherwise) that accept Apple Pay.

The loan payoffs will be split into four payments, and users will have six weeks to pay the loans off with no interest. The payments need to be made with a debit card, Apple says.When users initiate the loan, Apple performs a soft credit check before making an offer. A screen appears on the user's device that outlines the payment plan. Additionally, there is a screen within the Wallet app wherein users can track their loan balance and future payments on a calendar.

Apple Pay Later builds on Apple's existing relationship with Mastercard and Goldman Sachs; the service is "enabled through the Mastercard Installments program," which Apple says allows the service to work immediately with merchants that already accept Apple Pay. "Goldman Sachs is the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases," Apple says.

That said, Apple formed a subsidiary to finance Apple Pay Later loans—something it didn't do with Apple Card or Apple Pay before. The subsidiary will start reporting loans to US credit bureaus this fall.

As smartphone adoption has slowed down somewhat recently, Apple has spent several years branching beyond profits based on hardware sales, diversifying within a wide range of services like streaming entertainment, cloud backups, fitness, and financial productions.

Listing image by Apple

Article From & Read More ( Apple Pay Later turns Apple into a full-on money lender - Ars Technica )https://ift.tt/7AzuksU

Business

Bagikan Berita Ini

0 Response to "Apple Pay Later turns Apple into a full-on money lender - Ars Technica"

Post a Comment