-slav-

One of the headline news items over the past week has been the financial condition of First Republic Bank (NYSE:FRC). After the collapse of Silicon Valley Bank, which is owned by SVB Financial Group (SIVB), as well as both Signature Bank (SBNY) and Silvergate Capital Corporation (SI), investors and speculators alike zeroed in on First Republic Bank as perhaps the next domino to fall. In response to concerns over its health, management has worked to increase liquidity. But even in spite of this, shares have continued to drop after experiencing only a brief reprieve. While I was initially neutral on the company, I do think that recent developments have helped the firm to some degree. But because management is not being as transparent as they need to be, the market continues to punish the stock. To be fair, uncertainty does create a great deal of risk for investors. So because of that, I cannot in good faith rate the company in a bullish manner. But with how far the stock has fallen, and with the support the firm is receiving, I can understand why some investors might consider buying in at current prices.

Attempts to boost liquidity

The purpose of this article is not to provide a deep dive into the financial health of First Republic Bank. I already did that in a prior article that you can read here. Rather, it's to touch on some more recent developments that could have a significant role to play in the company's future moving forward. When cracks first began to form in the financial space, the management team at First Republic Bank was quick to act. On March 10th, the company provided investors with some additional detail regarding its potential exposure. For instance, the firm announced on that day that it had $60 billion of available and unused borrowing capacity split between the Federal Home Loan Bank and the Federal Reserve Bank. The company also said that its consumer deposits had average account sizes of less than $200,000, while business deposits had an average account size of less than $500,000. This is significantly different from a firm like Silicon Valley Bank, which had 97% of its deposits held by deposit customers that had in excess of $250,000 per account, with an average account size of $4.2 million for that group. The company also stated that technology-related deposits made-up only 4% of total deposits.

Although this announcement was intended to ease concerns that any investors might have, it started a tremendous amount of speculation as to why the company would need to seek out additional liquidity to begin with. That is likely what caused the bulk of the bank run on the firm and was responsible for the significant decline in share price that we have seen in the prior few days. I say this because, from March 3rd through March 10th, shares of the business declined from $123.22 to $81.76. But then, on March 13th, the first trading day after this announcement, shares plunged to $31.21. This was in spite of a subsequent announcement on March 12th that the company had increased its liquidity further from $60 billion to $70 billion, with that number excluding additional liquidity that the firm was eligible to receive under the new Bank Term Funding Program that the Federal Reserve announced that day.

As the days have gone on, management has come out with even more developments that are structured to let investors know that everything should be okay. On March 16th, for instance, the company announced that it received $30 billion in uninsured deposits that were committed to it by major banks like Bank of America (BAC), Citigroup (C), JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), Morgan Stanley (MS), Bank of New York Mellon (BK), PNC Bank (PNC), State Street (STT), Truist Financial Corporation (TFC), and U.S. Bancorp (USB). These organizations, it should be said, did not do this out of the kindness of their hearts. This maneuver does a number of things. For starters, it helps to shore up First Republic Bank in a manner that should reduce the risk of the contagion spreading. Second, it's highly likely that, although the deposits are uninsured, they would be honored by the federal government just as all deposits from the recent bank failures have been. And finally, there's the obvious reputational angle here in the sense that such a maneuver signals to depositors and shareholders of those banks that they are in sound enough financial condition to dole out cash that, in theory, is at risk if things go south.

Though it may seem odd to see private firms work to bail out their competitors, history is littered with examples of this taking place. In 1895, for instance, when the U.S. Treasury was near bankruptcy, the original J.P. Morgan decided to sell a portion of his firm's gold reserves to the government in exchange for a large 30-year bond. Morgan also stepped in during the panic of 1907, forming a coalition with other monied interests to bail out struggling financial institutions. You can look elsewhere throughout history to find examples of this kind of behavior as well. But with the rise of a more robust regulatory structure starting in 1913, these kinds of events have become incredibly rare.

First Republic Bank

All of this looks great at first glance. But then, we end up with some other interesting information. Management at First Republic Bank stated that from March 10th through March 15th the bank borrowed anywhere between $20 billion and $109 billion in any given night from the Federal Reserve at the effective overnight rate of 4.75%. That's a significant range and suggests that deposit withdrawals might have been extraordinarily high during this time. And since March 9th, the company increased short-term borrowings from the Federal Home Loan Bank by $10 billion. To be fair, management did say that insured deposits have been stable during this time of turbulence and that daily deposit outflows have 'slowed considerably'. But because management has not revealed what those withdrawals have looked like, we have no idea what the overall state of the bank is today, except for the fact that current cash as of March 15th, excluding the $30 billion coming from the aforementioned banks, stood at $34 billion. That was a significant improvement over the $4.3 billion reported for the end of the 2022 fiscal year.

First Republic Bank

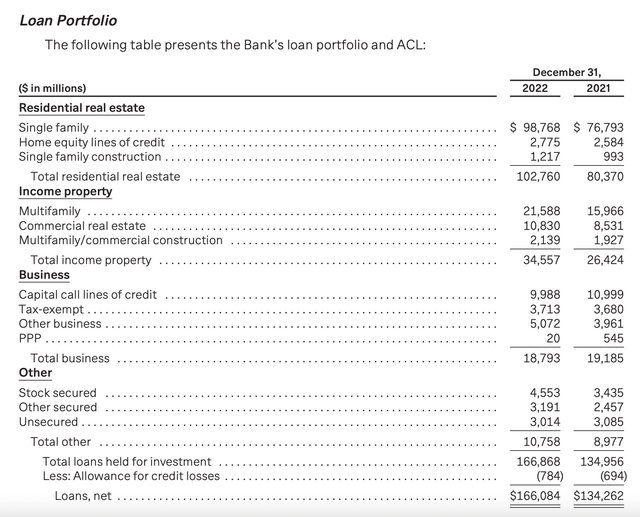

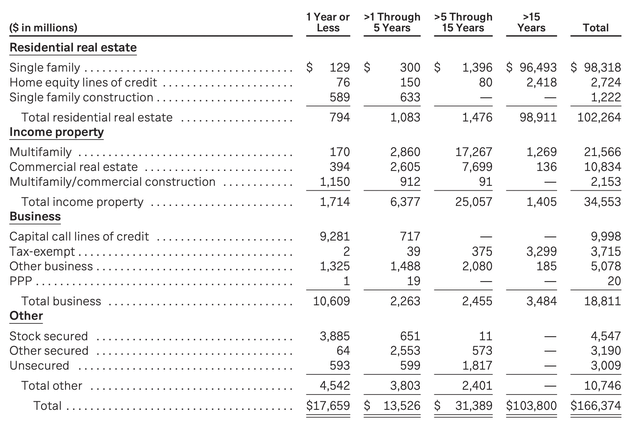

In theory, all of this liquidity that the company is receiving is something that they must eventually pay back, much of it with interest. In essence, it's a stopgap measure, not a solution to the company's problems. If withdrawals have not been all that awful, the firm can survive this just fine. But we don't know that to be the case and, given the magnitude of borrowings that the company has undergone that I highlighted above, it's likely that withdrawals were rather large. At some point, this means that the business must sell off some of its securities. The only securities that the company has on its books that are large enough to cover significant withdrawals would be the loans that it has given out. As of the end of the 2022 fiscal year, the company had residential real estate loans totaling $102.8 billion. Of this amount, $98.8 billion was in the form of single-family properties. The firm also has income property loans of $34.6 billion, business loans of $18.8 billion, and a combination of other miscellaneous loans of $10.8 billion.

Redfin

Redfin

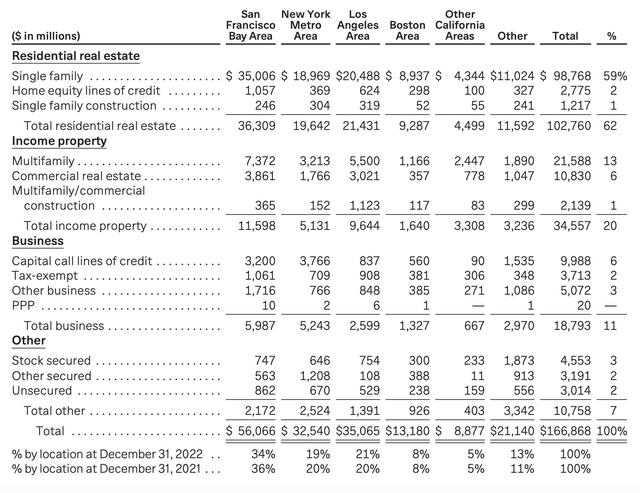

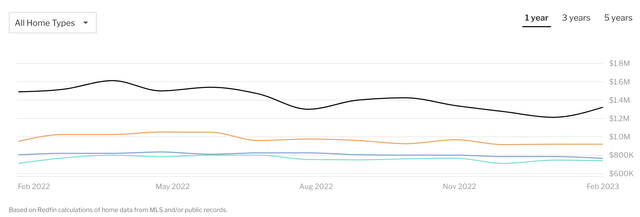

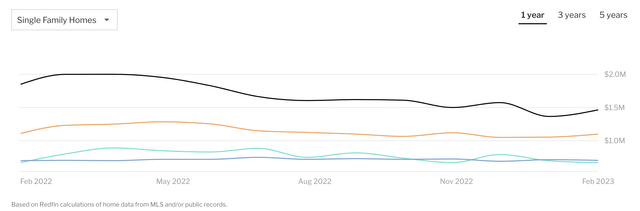

Higher interest rates undoubtedly make loans, especially fixed loans, less appealing. Not only are these securities sensitive to interest rates, they also become riskier because of the higher risk of default caused by interest rate increases. You also have the fact that these loans only have value because they are backed by the properties they cover. And if those properties drop in value, you end up with additional risk for the holders of the loans as well. With a significant amount of exposure to the San Francisco Bay Area, it doesn't bode well that, in the month of February of this year, home prices were down 11.2% compared to what they were one year earlier. For single-family homes, median sales prices were down 20.8%. The company also has a sizeable presence in New York. In February, home prices were down 4.8% compared to what they were one year earlier, though single-family prices were up a modest 0.6%. Los Angeles prices were down 3.2% compared to the 0.9% decline seen for single-family properties. In Boston where the company also has a good amount of exposure, prices were up 4.2% year-over-year in February. But for single-family properties, they were down 0.2%. Add on top of this the need of the business to sell a large portion of these if withdrawals have been significant, and you end up with the possibility of losses that the bank might need to take.

First Republic Bank

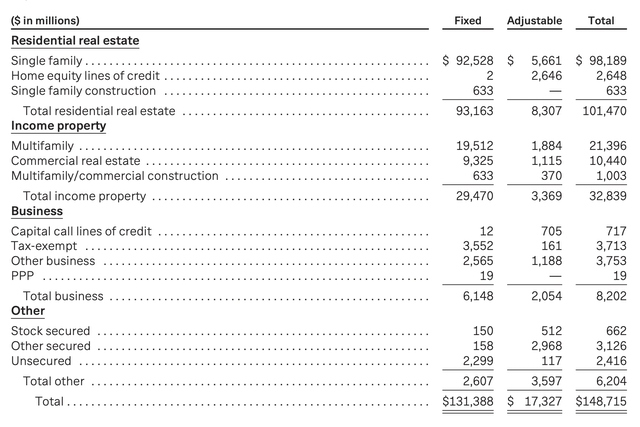

There are some other interesting pieces of information to put out there. As would be expected of a loan portfolio that involves real estate, a large portion of the loans, as measured by current unpaid balances, have maturities that are longer-term in nature. 62.4% of the loans on the company's books mature more than 15 years from the end of 2022. What makes matters really precarious though is that 88.3% of all of the loans on the company's books that have a maturity of greater than one year carry with them fixed interest rates. Again, as interest rates rise, the value of these mortgages should drop. And on top of this, 59% of all single-family loans involve an interest-only period (typically 10 years according to management). Although interest-only loans have become more popular after experiencing a plunge in popularity because of the last housing crisis, they do still have a limited market. But when added to declining property values, rising interest rates when many of the loans are fixed rate, and general economic concerns, this creates additional risk for investors.

First Republic Bank

Another interesting piece of information involves the possibility of the company being sold off. That could come as soon as next week if rumors are correct. But given all of the volatility that has been seen in the market, a take-under as opposed to a takeover might not be out of the question. A take-under occurs when the acquirer pays less for the company than what the market has valued it at. One of the most extreme examples from the housing crisis involved Bear Stearns. In 2008, despite trading at $30 per share shortly before the deal was announced, JPMorgan Chase agreed to acquire the enterprise for only $2 per share. That translated to $236 million, which was significantly cheaper than the $1 billion that the firm's headquarters building was valued at. Of course, the downside of this to the acquirer is that they then accept any risk associated with the acquired assets.

Takeaway

At this point in time, First Republic Bank is still in a very odd spot. I appreciate what information management has come out with recently. But frankly, it's not enough. To hear discussions about liquidity improving and deposits coming in from large banks does not show the entire picture. All it does is show that management is responding to a problem of uncertain, but almost certainly tremendous, magnitude. I do believe that investors who buy in today do have an opportunity at achieving significant upside. But until management can come out with a more comprehensive picture that shows exactly what has happened with deposits, and what kinds of terms they have had to accept on monetizing various assets, if any have been monetized, I believe that the company is not one that prudent investors should touch at this time.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Article From & Read More ( First Republic Bank: When Opacity Kills Opportunity (NYSE:FRC) - Seeking Alpha )https://ift.tt/QvnXNfV

Business

Bagikan Berita Ini

0 Response to "First Republic Bank: When Opacity Kills Opportunity (NYSE:FRC) - Seeking Alpha"

Post a Comment